“If we removed janitors and doctors from this planet, we would see the consequences immediately…

If we removed shareholders, we wouldn’t see any difference, hence shareholders steal value and don’t produce anything”

Typical family-dinner rant

As war is raging in Ukraine, prices are rising and mechanically, some companies record all-time high revenue streams.

By no means is this equivalent to high profit, but beyond this consideration, shareholders will sometimes earn dividends.

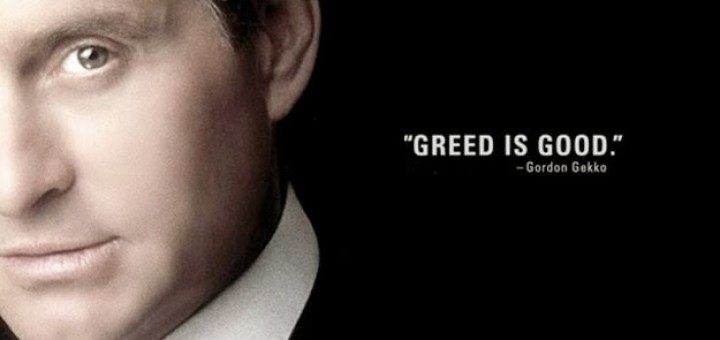

And this is precisely what I read, amazed, in the press of a few countries: most of the time, the motto of what I read was that greedy shareholders were obsessed with money, hence forcing employees into starvation…

Of course, aside from the political narrative and the anti-shareholder rant, there is an interesting question here: why would an investor or a shareholder have to be anything else than greedy?

Most people indulging in this anti-shareholder rant are usually not well-trained in economics, nor did they ever found a company, yet there are politicians, and even economists who will complain about the shareholder’s greed.

Some people even go as far as saying that removing a shareholder wouldn’t have any impact on an economy, proving that shareholders would therefore be useless and not create any value.

But things couldn’t be further from naivety.

If I ignore the pejorative judgement implying that being greedy is a bad thing, let’s imagine for a second a world where shareholders wouldn’t be greedy, shall we?

A professional investor invests money in order to generate revenue: this means that every investment has to be extremely careful. First of all, a professional investor will not invest all of their funds in a single business to mitigate risk (whereas an amateur investor, a friend giving you love-money, or a gambling-investor will have no problem with that).

In the little world of startups, we estimate that usually, an investor needs to generate a 100x profit in order to find a startup worthy of interest. Does that mean that every startup will generate that? No, that’s quite the opposite. Even the best incubators such as Y Combinator will have a low success rate. According to YC’s Jared Friedman, if 40% of a batch’s startups turn profitable, they will estimate that this will have been an awesome year…

But for us, mere mortals, around 1% of startups become cash-flow positive. What does that mean, then? It’s a very simple calculation that (almost) anyone can understand: if 1% of startups end-up being profitable, 99% of them are a waste of money.

A good investor will optimize these odds by choosing projects with a solid-looking team, of people who work well with each other, with a lot of experience, and a sane business model and technology. But in any case, if 99% startups fail, that means that for a dollar invested, you’ll lose 99… In other words: this last profitable startup has to cash in a 100x profit AT LEAST to compensate for the loss of other startups.

So when a company is profitable, investors turned-shareholders DO have to become greedy and demand their dividends. They can make an effort in hard times if they can afford it, but it is not a given that they will do so.

Are investors and shareholders greedy? Yes they are, otherwise they wouldn’t survive their first investment, and there couldn’t be any further investment.

Conclusion: you should be greedy too!